Taxes in UAE for Expats: Complete 2025 Guide

The United Arab Emirates (UAE) has long been recognized as one of the most attractive destinations for expatriates. With its thriving economy, global business hub, modern infrastructure, and a tax system that is remarkably expat-friendly compared to most countries, it continues to attract millions of foreigners every year.

For many expats, the biggest attraction is the tax-free salaries. While there is no personal income tax, there are other forms of taxation that expatriates and foreign residents should be aware of. This article provides a complete 2025 guide on taxes in the UAE for expats, including how to calculate them, the different types of taxes applicable, and even refund opportunities for tourists and residents.

Is There an Income Tax for Expats in the UAE? (UAE tax system for expats)

One of the most significant benefits of working in the UAE is the absence of personal income tax. Expats working in Dubai, Abu Dhabi, Sharjah, or any other emirate do not have to pay taxes on their salaries or wages. This is true across industries—from construction workers to executives in multinational corporations.

Key point: No income tax applies to salaries, allowances, bonuses, or other employment income for expatriates.

Types of Taxes in the UAE for Expats (taxes for foreigners in UAE)

Although the UAE does not impose a direct income tax, several other taxes apply indirectly to expats, tourists, and residents.

1. Value Added Tax (VAT) (VAT in UAE for expats)

- Introduced in 2018 at a standard rate of 5%.

- Applies to most goods and services.

- Essential items like healthcare and education are either exempt or zero-rated.

- Expats pay VAT when purchasing products, eating out, or using paid services.

Example: If you buy a laptop worth AED 3,000, the VAT applied would be AED 150 (5%).

2. Excise Tax in UAE

Excise tax is aimed at reducing the consumption of harmful goods. Rates include:

- 50% on carbonated drinks.

- 100% on tobacco and energy drinks.

- 50% on electronic smoking devices and sugary drinks.

This applies equally to both residents and expats.

3. Corporate Tax in UAE (corporate tax in UAE for expats)

- Introduced in June 2023 at a rate of 9% for business profits exceeding AED 375,000.

- Applies to both local and foreign businesses operating in the UAE.

- Expats running their own companies or having business ownership shares may be liable.

4. Customs Duties in UAE

Generally set at 5% on imported goods.

5. Municipality Taxes in UAE

- Applicable on property rentals and utility services.

- For expats renting apartments, an annual housing fee (typically 5% of annual rent) is charged via electricity and water bills.

6. Tourism Taxes in UAE (tourist tax refund UAE)

- Hotels and restaurants apply additional service charges and tourism fees.

- Typically ranges between 6–10% depending on emirate.

7. Road Tolls (Salik in Dubai)

- Though not a traditional tax, Salik is a road toll system in Dubai.

- Expats owning vehicles must pay toll charges electronically when crossing certain routes.

How to Calculate Taxes in UAE for Expats

While there is no complex personal income tax calculation, expats need to understand how VAT, excise, and other indirect taxes are applied.

Example 1: VAT on Everyday Purchases

- Grocery shopping: AED 500

- VAT (5%): AED 25

Total payable: AED 525

Example 2: Excise Tax on Beverages

- Energy drink: AED 10

- Excise Tax (100%): AED 10

Total payable: AED 20

Example 3: Housing Fee in Dubai (housing fees in Dubai)

- Annual rent: AED 100,000

- Municipality housing fee (5%): AED 5,000

- Monthly addition to DEWA bill: AED 416.66

Example 4: Corporate Tax for Business Owners

- Annual profit: AED 600,000

- Tax-free threshold: AED 375,000

- Taxable amount: AED 225,000

- Corporate tax (9%): AED 20,250

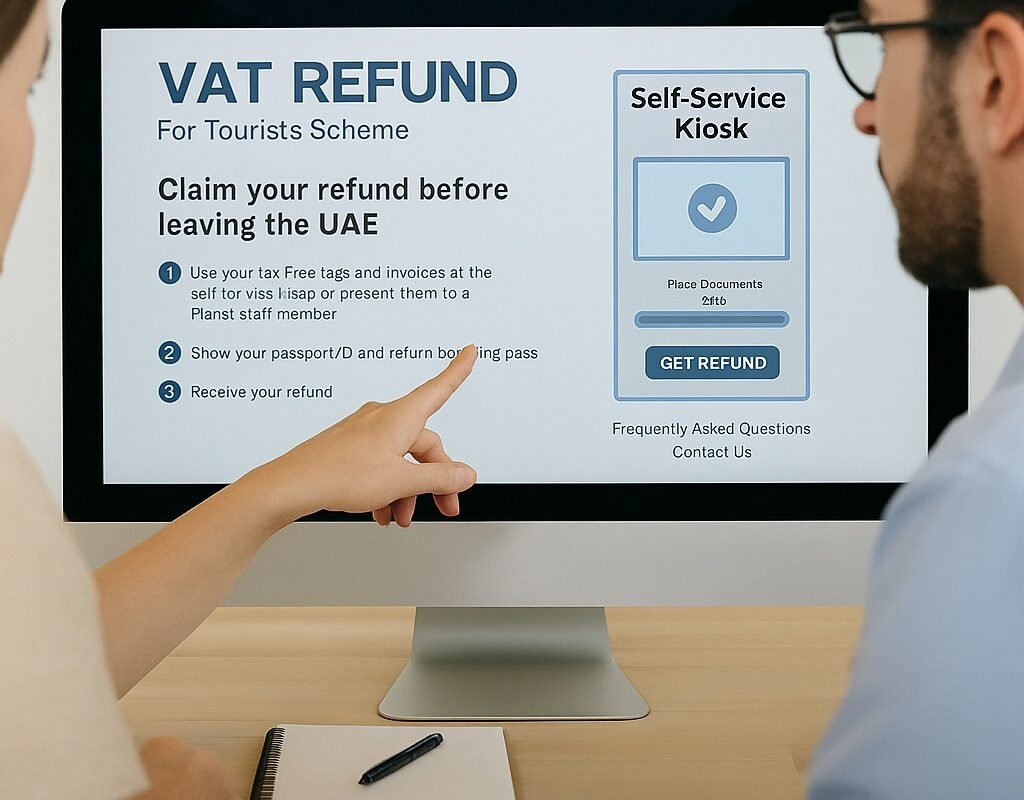

Refundable Taxes for Tourists and Foreign Residents (tax refund UAE residents)

The UAE provides an efficient system for refunding VAT to eligible tourists and visitors.

1. VAT Refund for Tourists in UAE (vat in uae 2025)

- Tourists can claim VAT refunds on goods purchased in the UAE.

- Refunds are available if the retailer is part of the Tax Refund for Tourists Scheme.

- Claim process: Present tax invoice + passport at airport kiosks.

- Refund is given in cash or credited back to card.

2. VAT Refund for Foreign Businesses

Businesses from countries with reciprocal agreements can reclaim VAT on UAE expenses.

3. Non-Refundable Taxes in

- Excise tax and municipality taxes are non-refundable.

- Tourism fees and road tolls (Salik) are also non-refundable.

Why Taxes in UAE Are Important for Expats to Understand

Financial Planning: Understanding indirect taxes helps expats budget more effectively.

Business Compliance: For expat entrepreneurs, corporate tax compliance is mandatory.

Tourist Savings: Knowledge of refund policies helps visitors save money.

Legal Protection: Ensures expats are not overcharged or misled about hidden fees.

Tips for Expats on Managing Taxes in UAE (VAT UAE)

- Keep all VAT invoices if planning to claim refunds.

- Register your business with the Federal Tax Authority (FTA) if taxable.

- Include municipality housing fees when calculating total accommodation cost.

- Use government portals like FTA and DEWA for accurate tax calculations.

Conclusion

The UAE remains one of the most attractive global destinations for expatriates, thanks to its no-income-tax policy. However, expats must remain aware of VAT, excise, corporate tax, municipality fees, and tourism charges. Tourists can reclaim VAT on purchases, but other indirect taxes are not refundable. By understanding and planning around these taxes, expatriates can enjoy financial clarity while maximizing the benefits of living in the UAE.

Disclaimer :

The information provided in blog articles and how-to guides on the LinkArabia website is for general informational purposes only. While we strive to provide accurate and up-to-date content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information. Any reliance you place on such information is strictly at your own risk. For more information , please read linkarabia disclaimer policy.