How to Get VAT Refund in UAE: A Complete Guide for Tourists in 2025

The United Arab Emirates (UAE) introduced Value Added Tax (VAT) in January 2018 at a standard rate of 5%. While VAT applies to most goods and services purchased within the UAE, the government also created a VAT Refund Scheme to support international tourists.

This allows visitors to reclaim the VAT they pay on eligible purchases before leaving the country. If you are a tourist or a foreign resident visiting the UAE, understanding the VAT refund process will help you save money and enjoy your trip more effectively.

This guide explains step by step how to claim a VAT refund in the UAE, what documents you need, which purchases qualify, and how the refund process works at airports, seaports, and land borders

Who Is Eligible for VAT Refund in UAE?

Before diving into the steps, you need to check if you qualify:

Eligible:

- Tourists (non-residents of UAE).

- Foreign residents visiting UAE.

- Tourists over 18 years old.

Not Eligible:

- UAE residents.

- GCC nationals from countries that do not apply VAT.

- Airline crew members.

What Purchases Qualify for VAT Refund in UAE? (vat uae login)

Not all purchases are eligible. To qualify, the goods must meet the following conditions:

Purchased from a retailer registered under the Tourist Refund Scheme.

Goods must not have been consumed before leaving UAE.

Total purchase must meet the minimum amount (currently AED 250 including VAT).

Services such as hotel stays or restaurant bills are not refundable.

👉 You can check official VAT refund details at the Federal Tax Authority FTA UAE website:

🔗 https://tax.gov.ae

Documents Required for VAT Refund in UAE (documents required for VAT refund UAE)

- To claim your VAT refund successfully, you must prepare the following documents:

- Original passport (or GCC ID).

- Original purchase receipts/invoices with VAT details.

- Tax-free tags issued by the retailer (digital or paper).

- Boarding pass / flight details.

- Credit card (if refund to card) or cash option.

Step-by-Step Process: How to Get VAT Refund in UAE (vat uae registration)

Step 1: Shop at Registered Retailers

- Look for stores displaying the “Tax Free Shopping” sign.

- Ask the retailer to issue you a tax-free invoice (digital or printed).

- Minimum purchase: AED 250.

Step 2: Collect Your Tax-Free Tag

- The retailer will issue a tax-free tag (linked to Planet Payment system).

- Attach it to your invoice.

- This tag will be required at refund points.

Step 3: Head to the Airport/Exit Point ((VAT Refund UAE)

Refund kiosks are available at:

- Dubai International Airport (DXB)

- Abu Dhabi International Airport (AUH)

- Sharjah International Airport (SHJ)

- Seaports and land borders like Al Ghuwaifat.

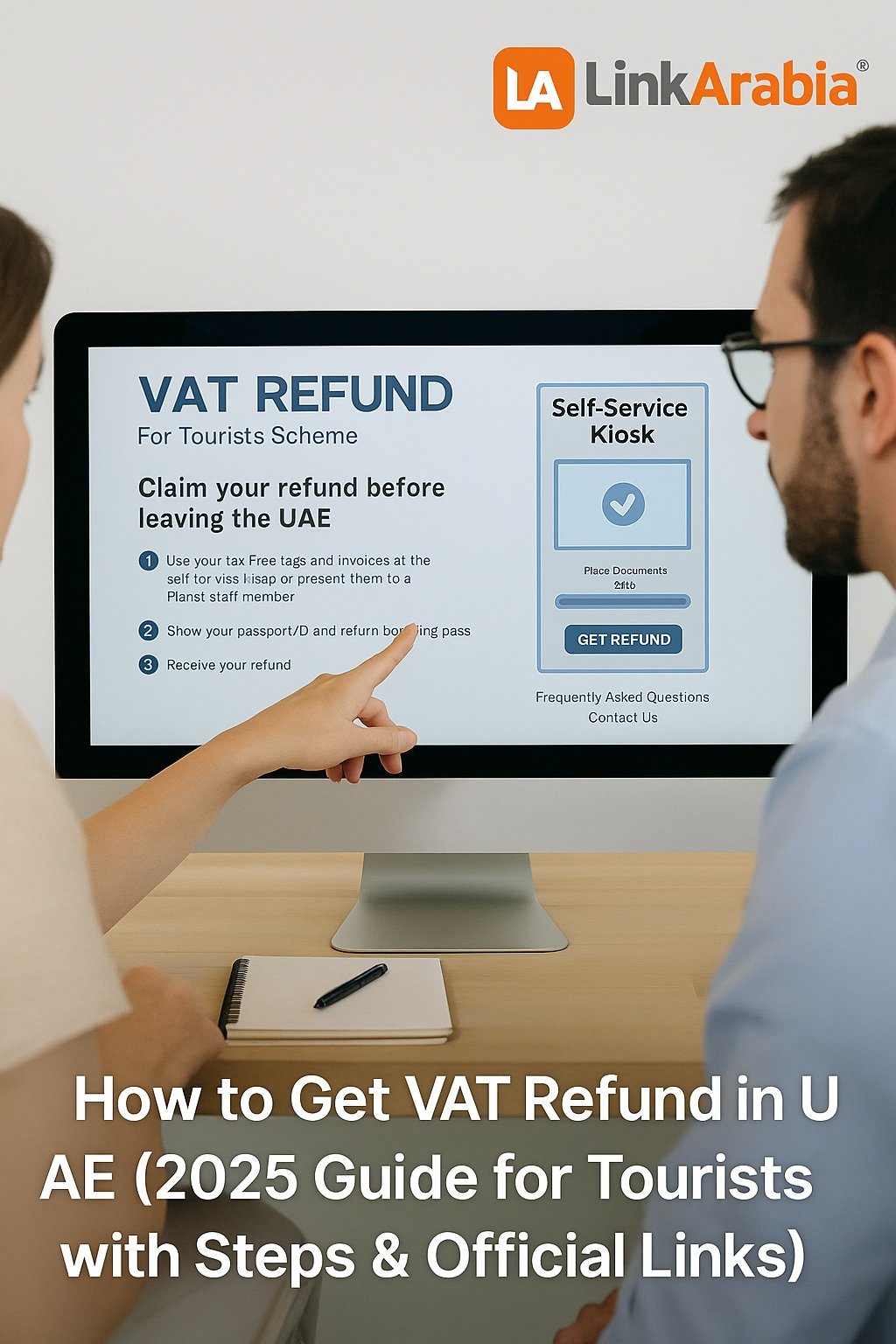

Step 4: Visit the VAT Refund Kiosk on UAE Airport (UAE tax refund for tourists)

- At the airport, follow signs for “VAT Refund for Tourists”.

- Go to the self-service kiosks operated by Planet Payment (FTA’s partner).

- Official Refund Portal: 🔗 https://www.planetpayment.ae

Step 5: Scan Your Documents (vat uae rules)

At the kiosk, you will be asked to:

Scan your passport or GCC ID.

Scan your boarding pass.

Scan the tax-free invoices.

Step 6: Select Refund Option

You can choose between:

- Cash Refund (available at airport counters, with small admin fee).

- Credit Card Refund (directly to your card).

Step 7: Confirm & Collect Refund

- The system will validate purchases instantly.

- If approved, you will receive your VAT refund minus admin fees.

UAE VAT Refund Fees and Limits

- Maximum cash refund per tourist per day: AED 10,000.

- Refunds over this amount must be credited to your bank card.

- Service fees apply (typically 4.8 AED + 20% of VAT amount).

Tips to Maximize Your UAE VAT Refund

- Always shop at registered retailers.

- Keep invoices in good condition.

- Arrive early at the airport (refund process can take time).

- Choose card refund if claiming higher amounts.

- Double-check your eligibility before traveling.

Conclusion

The VAT refund system in the UAE is an excellent initiative for tourists, making the country even more attractive for shopping and tourism. By following the official steps and preparing documents in advance, tourists can claim back 85% of their VAT payments efficiently.

Whether you are shopping in Dubai Mall, exploring Abu Dhabi, or buying souvenirs in Sharjah, your VAT refund ensures you save money while enjoying world-class shopping experiences in the UAE.

Disclaimer :

The information provided in blog articles and how-to guides on the LinkArabia website is for general informational purposes only. While we strive to provide accurate and up-to-date content, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information. Any reliance you place on such information is strictly at your own risk. For more information , please read linkarabia disclaimer policy.